Kinective

...

Market context

Scope: research >positioning >strategy > naming >TOV >visual identity >illustration >brand guidelines >website

Sector: Banking/Fintech

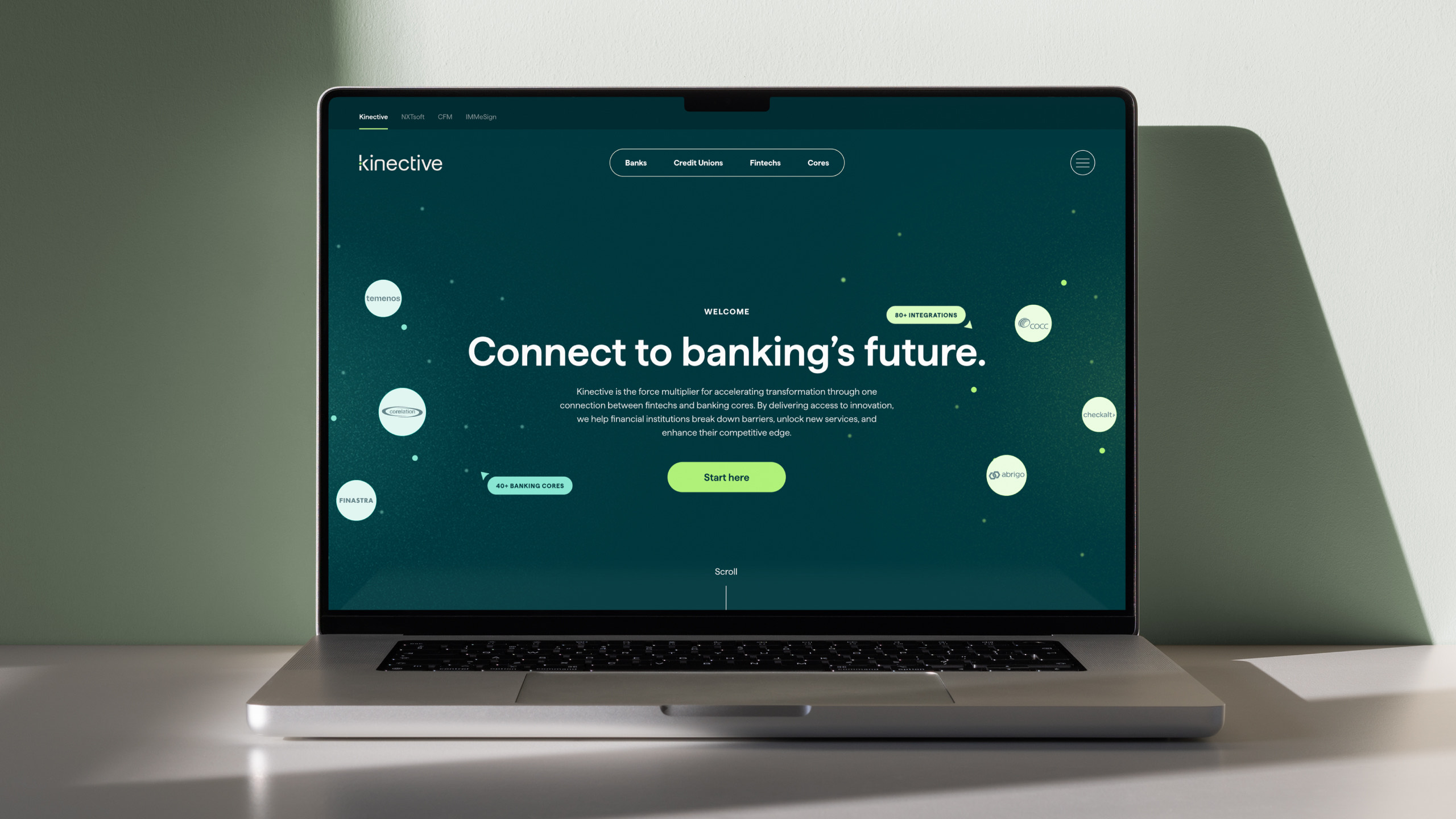

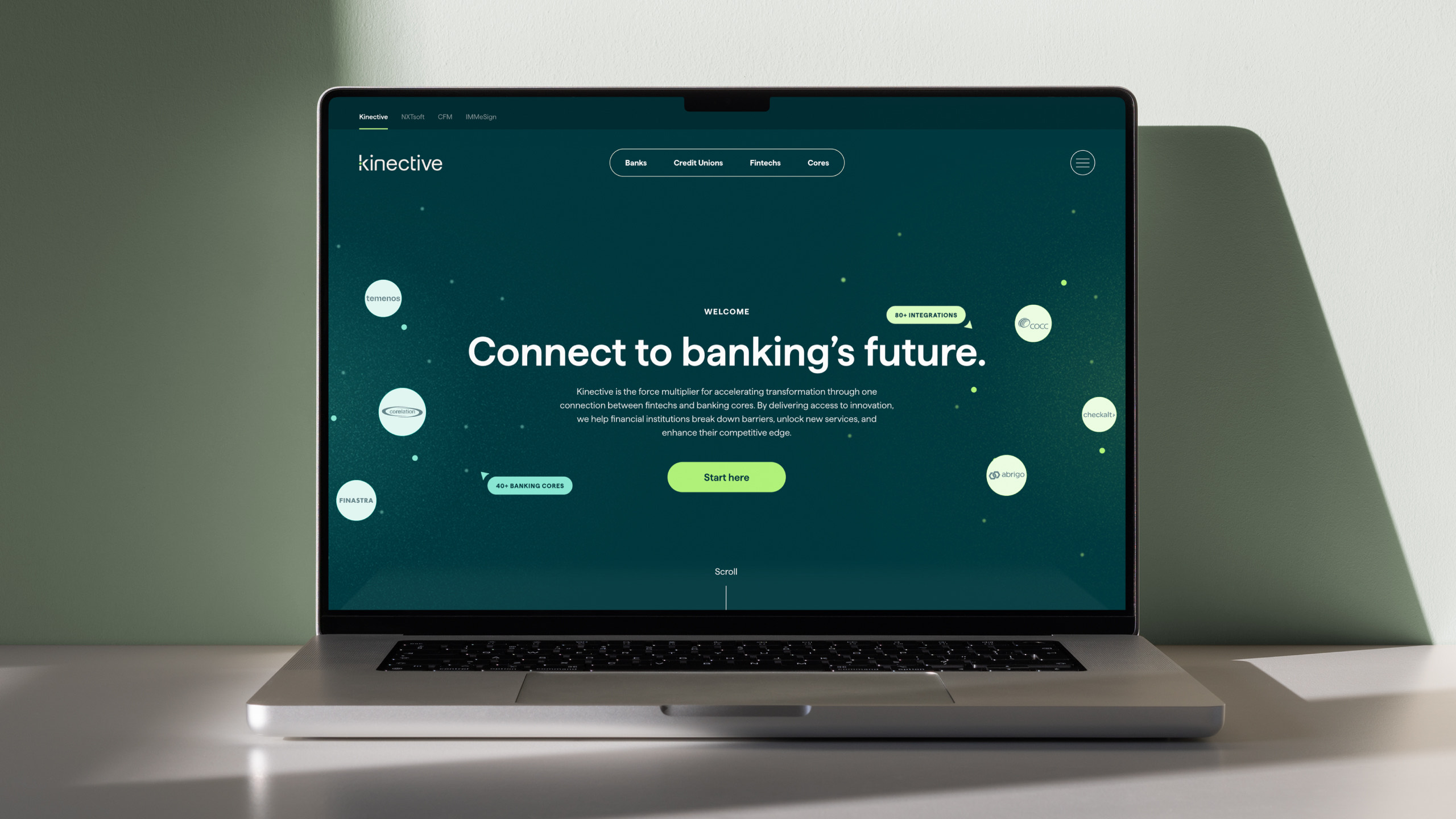

Kinective is an Integration Platform as a Service (iPaaS) which operates within the fintech arena. It provides API connectivity, workflow automation, and data analytics software to almost 2000 banks and credit unions across North America.

Working with three core audiences, (banks, credit unions and fintechs), Kinective delivers the most comprehensive, open, and connected technology ecosystem in finance. Acting as a force multiplier, it enables these financial institutions to accelerate their transformation efforts through a single connection between fintechs and banking cores.

Challenge

Kinective was created and launched in 2023, as a unifying brand for CFM, NXTsoft, and IMM – three complementary financial technology companies that operate in the banking sector.

A review of the existing entities revealed outdated brands with mixed messaging and multiple visual identities, in addition to inconsistent online and retail banking experiences. The result of which weaked the overall brand experience.

Therefore, the creative response had to merge these disparate systems into a unified brand experience, ensuring it reflected Kinective’s interoperability among its core audience. Kinective's product solutions continue to draw from existing CFM, NXTsoft, and IMM products, which will remain available and supported.

Connect to banking’s future

Through explorative conversations with CFM, asking the tough questions, we gained ground-breaking insights that shaped our strategy. Our discovery sessions revealed that its iPaaS competitors were perceived as restrictive, lacking scalability and overly complicated.

This presented an opportunity for Kinective to own scale and simplicity, and to offer its customers a connected experience centred around them – a one-stop portal that connects their banking customers to a world of high-tech fintech solutions.

The strategic approach surfaced a new proposition, ‘connect to banking’s future’, which resonates with Kinective's three core audiences and positions it as a powerful facilitator within the iPaaS market.

Creative

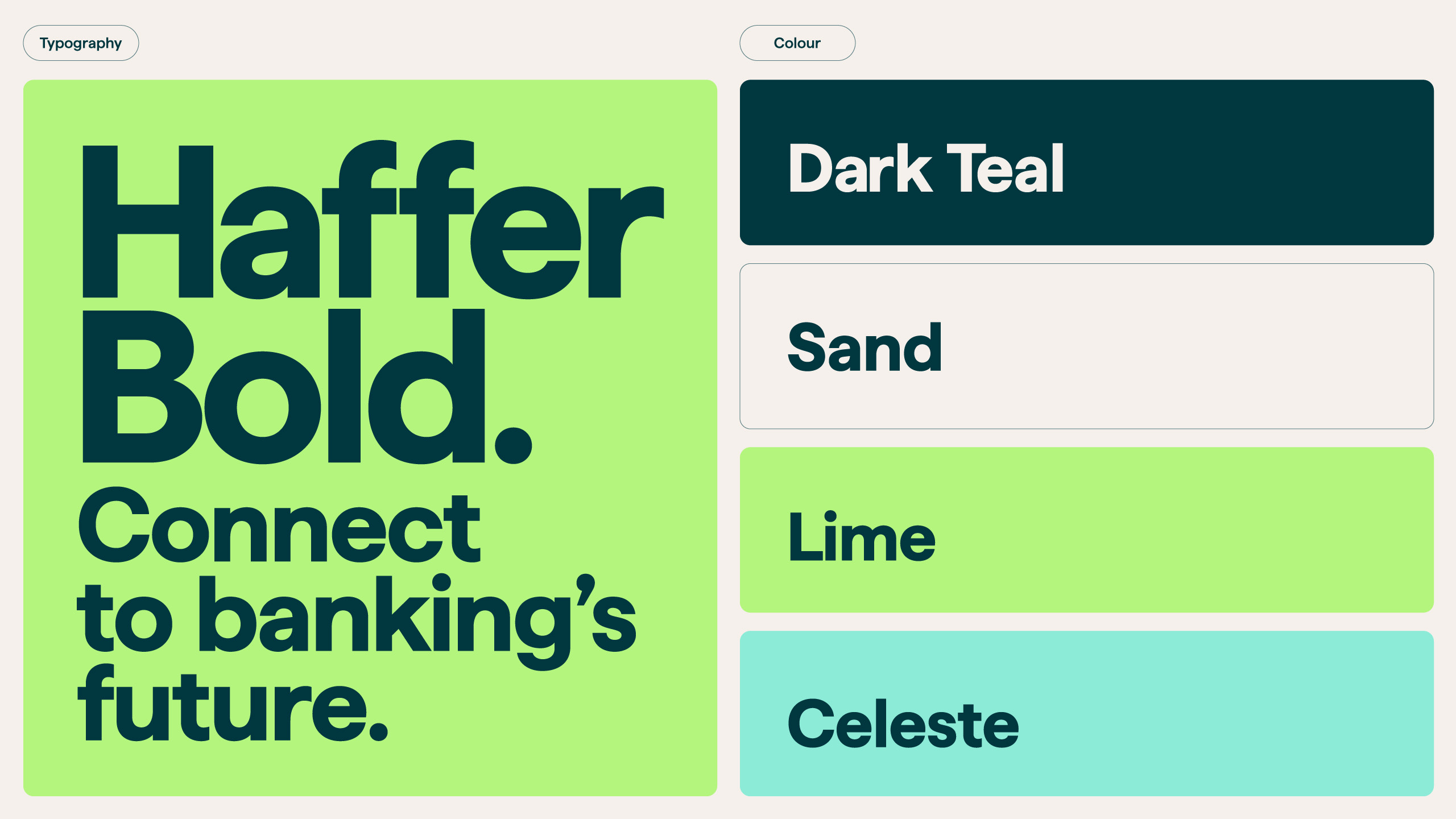

Working with Kinective’s mission to help customers to ‘connect to banking’s future’ and the need to elevate and distance the brand from the poor perception of iPaaS’, the creative had to provide a standout solution.

The core brand idea brought Kinective to life through a simple yet powerful brand identity that will future proof the brand for years to come.

Naming: The new company name ‘Kinective’ is derived from the word connective. It is evocative of the driving power of innovation and kinetic energy.

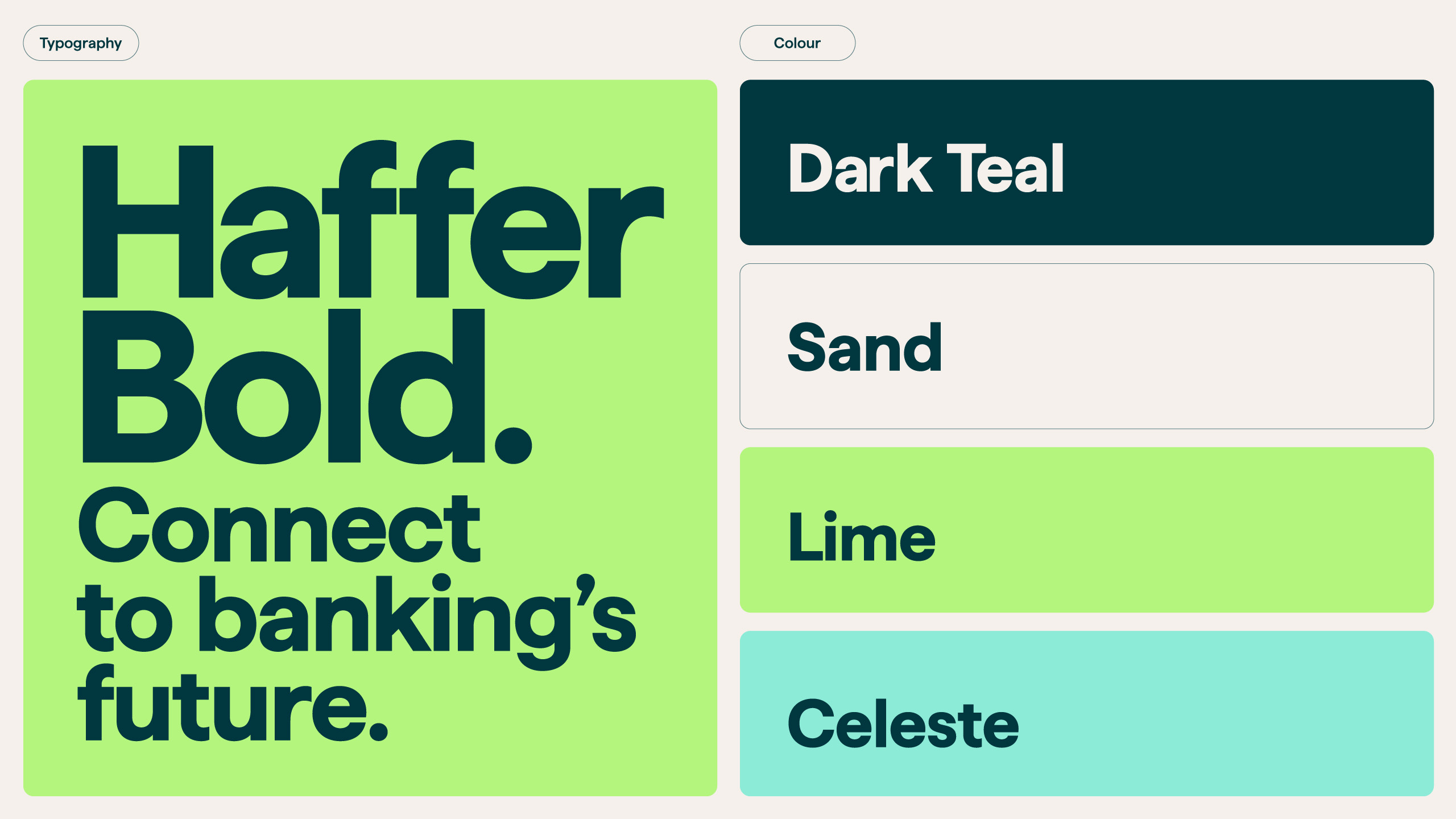

Creative: The creative strategy is built on the brand purpose and brought to life using a set of clear design principles that reflect the brandvision.

The brand personality was manifested through a simple 'connect the dots' concept, putting connectivity at the heart of the story, supported by a rich visual system that conveyed the scale and innovation of the business.

Messaging: A simple yet empathetic messaging and TOV enables Kinective to move beyond the cold banking world of 'ones and zeros', to focus on the human impact of the brand. This reflects the customer-centric culture that values every individual and their unique needs.

"We are thrilled to offer our customers a cohesive experience by launching Kinective, which leverages the combined solutions, resources, and seven decades of experience of our three complementary businesses. Our brand connects our employees and customers under a shared vision and reflects our mastery in building connected digital experiences for financial institutions.

Digital transformation in banking has been impaired by unavailable, incomplete, or vulnerable integrations between cores and fintechs. Kinective is a force multiplier in banking, enabling immediate access to innovation via integrations to cores used by 99% of U.S. financial institutions. Kinective’s software help banks and credit unions unlock new services, modernize operations, and enhance their competitive edge."

Stephen Baker, CEO, Kinective

Let's talk about your growth ambitions.